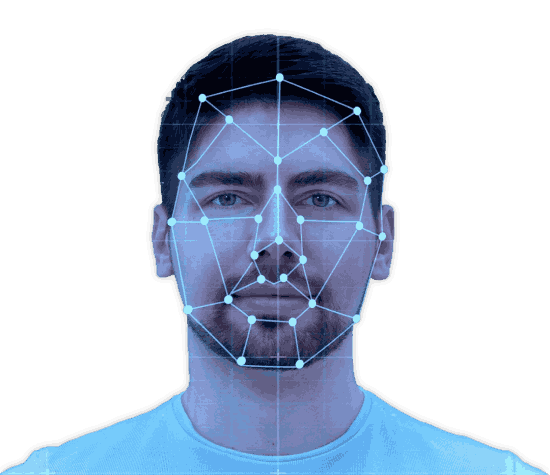

Key Features of Our Face Liveness Detection API :

Fast Processing:

Detects live human faces within milliseconds.

Compatibility:

Works seamlessly with all facial recognition system devices.

Spoof Prevention:

Protects against spoofing using photos, videos, or masks.